The Intent of an AI Claim Scrubbing Agent

Healthcare revenue cycle management faces a persistent challenge: claim denials. Each denied claim costs providers an average of $25-$118 to rework, with billions lost annually due to unrecovered denials. An AI-powered claim scrubber aims to intervene before submission, identifying claims with high denial probability and enabling proactive correction. By assigning likelihood scores to claims, the system helps prioritize work efforts, reduce denials, accelerate payments, and ultimately improve the financial health of healthcare organizations.

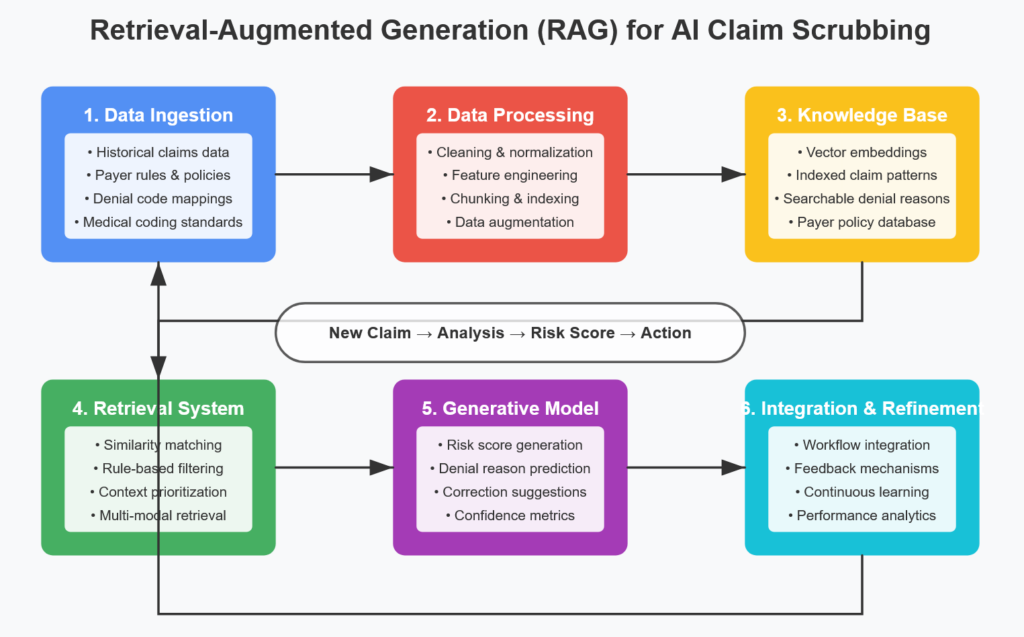

Building the Foundation: Data Collection and Preparation

The effectiveness of your AI claim scrubber depends on comprehensive, high-quality data. Here’s how to build this foundation:

Historical Claims Data

Begin by collecting at least 18-24 months of historical claims data, including:

- Claim details (CPT/HCPCS codes, diagnosis codes, modifiers)

- Patient demographics (age, gender, insurance type)

- Provider information (specialty, credentials, NPI)

- Service location and type (inpatient, outpatient, telehealth)

- Payer information (plan types, contract details)

- Adjudication outcomes (paid, denied, partial payment)

- Denial reason codes and descriptions

- Resubmission and appeal history

- Payment timing metrics

- Prior authorization status

Data Preparation and Cleansing

Healthcare claims data requires significant preparation:

- Standardize formats: Ensure consistent representation across all data sources

- Handle missing values: Implement strategies for incomplete records without introducing bias

- Normalize coding variations: Account for changes in coding practices over time

- Balance the dataset: Address potential imbalances between denied and paid claims

- Feature engineering: Create derived variables like claim complexity scores, provider denial rates, or payer-specific patterns

- Data labeling: Clearly differentiate between denial types (clinical, administrative, technical)

Privacy and Compliance Considerations

All data handling must adhere to:

- HIPAA requirements for protected health information (PHI)

- Relevant state and local healthcare privacy regulations

- Payer contract requirements for data usage

Developing the Predictive Model

With clean, comprehensive data in place, we can develop the AI model:

Model Selection

Several machine learning approaches have proven effective for claim denial prediction:

- Gradient Boosting Models: XGBoost and LightGBM excel at handling the complex relationships between claim elements and outcomes

- Random Forests: Provide good interpretability while capturing non-linear patterns

- Neural Networks: Can identify subtle patterns in complex coding relationships

- Ensemble Methods: Combining multiple models often achieves the best performance

Feature Importance Analysis

Understanding which factors most strongly predict denials helps both model development and practical interventions:

Top Predictive Factors (Example):

- Missing or invalid modifiers (24% importance)

- Diagnosis-procedure code mismatch (19%)

- Service frequency exceeding norms (16%)

- Prior authorization issues (12%)

- Provider credentialing status (9%)

- Patient eligibility gaps (8%)

- Bundling/unbundling issues (7%)

- Payer-specific coding requirements (5%)

Risk Scoring System

Rather than binary prediction, develop a nuanced risk scoring system:

- High risk (80-100): Claims likely to be denied

- Medium risk (40-79): Claims requiring additional review

- Low risk (0-39): Claims likely to be paid with minimal issues

This approach allows for tiered interventions based on denial probability.

Testing and Validation

Thorough testing ensures your AI system makes reliable predictions before deployment:

Evaluation Metrics

Focus on these key performance indicators:

- Precision and Recall: Balance between correct identification and comprehensive coverage

- Area Under the ROC Curve (AUC): Overall model discriminative ability

- False positive rate: Claims incorrectly flagged as likely denials

- False negative rate: Missed denial predictions

- Financial impact metrics: Projected revenue saved vs. intervention costs

Validation Approaches

Implement these validation strategies:

- Cross-validation: Test on multiple random data subsets

- Temporal validation: Test on future time periods to simulate real-world implementation

- Payer-specific validation: Ensure performance consistency across different insurance plans

- Shadow deployment: Run the system alongside existing processes to compare outcomes

- A/B testing: Apply interventions to a subset of claims to evaluate effectiveness

Implementation and Workflow Integration

A successful AI claim scrubber must integrate seamlessly with existing revenue cycle workflows:

Pre-Submission Review Process

For flagged claims:

- Tiered review queue: Prioritize claims based on risk score and potential revenue impact

- Root cause identification: Provide specific reasons for potential denial

- Correction recommendations: Suggest specific fixes based on historical patterns

- Documentation gaps: Flag missing elements needed for successful submission

- Payer-specific requirements: Highlight unique requirements for particular payers

Workflow Integration Points

Embed the AI system at critical points in the revenue cycle:

- Point-of-service: Validate eligibility and authorization requirements

- Charge entry: Flag coding issues in real-time

- Pre-billing review: Comprehensive claim scrubbing before submission

- Denial management: Predict appeal success likelihood

- Contract negotiation: Identify problematic claim patterns by payer

Staff Training and Adoption

Prepare your team to work effectively with the AI-powered system:

- Train billing staff to interpret risk scores and recommendations

- Develop clear protocols for different intervention levels

- Create documentation for common correction patterns

- Establish feedback mechanisms for improving system recommendations

Continuous Improvement

The AI claim scrubber should evolve over time:

Performance Monitoring

Track these metrics continuously:

- Clean claim rate (percentage of claims paid on first submission)

- Denial rate by category (clinical, administrative, technical)

- Average days in A/R

- Prediction accuracy by payer and claim type

- ROI of intervention efforts

- Staff time saved through automation

Model Retraining and Tuning

Schedule regular model updates:

- Retrain quarterly with new claims data

- Update for changes in payer policies

- Adjust for coding standard updates

- Incorporate feedback from successful appeals

- Fine-tune based on changing denial patterns

Continuous Feedback Loop

Implement a robust feedback mechanism:

- Outcome tracking: Record final disposition of all flagged claims

- False positive analysis: Identify and address patterns in incorrect predictions

- User feedback integration: Incorporate billing staff insights into model improvements

- Payer policy monitoring: Update the system as payer requirements change

- Regulatory updates: Adapt to evolving healthcare regulations

Results and Impact

When properly implemented, AI-powered claim scrubbers typically deliver:

- 30-40% reduction in denial rates

- 15-20% decrease in days in A/R

- 25-35% reduction in rework costs

- Improved cash flow predictability

- More efficient allocation of billing staff resources

- Data-driven insights for contract negotiations

Here’s how these improvements translate to financial outcomes for a mid-sized healthcare organization:

- Before AI Implementation:

- 20% denial rate on 50,000 annual claims

- $10M in denied charges

- $800,000 in annual rework costs

- $3M in unrecovered revenue

- After AI Implementation:

- 12% denial rate on 50,000 annual claims

- $6M in denied charges

- $480,000 in annual rework costs

- $1.8M in unrecovered revenue

- Net annual improvement: $1.52M

Conclusion

AI-powered claim scrubbing represents a transformative approach to revenue cycle management. By predicting potential denials before submission, these systems not only recover lost revenue but also create a more efficient workflow that benefits providers, staff, and ultimately patients through a healthier financial ecosystem.

The most successful implementations combine sophisticated predictive modeling with thoughtful human oversight. When AI augments human expertise rather than replacing it, the result is a more efficient revenue cycle that maximizes reimbursement while minimizing administrative burden.

As healthcare financing grows more complex, AI claim scrubbers will become an essential tool for financial sustainability, allowing providers to focus less on paperwork and more on what matters most—patient care.